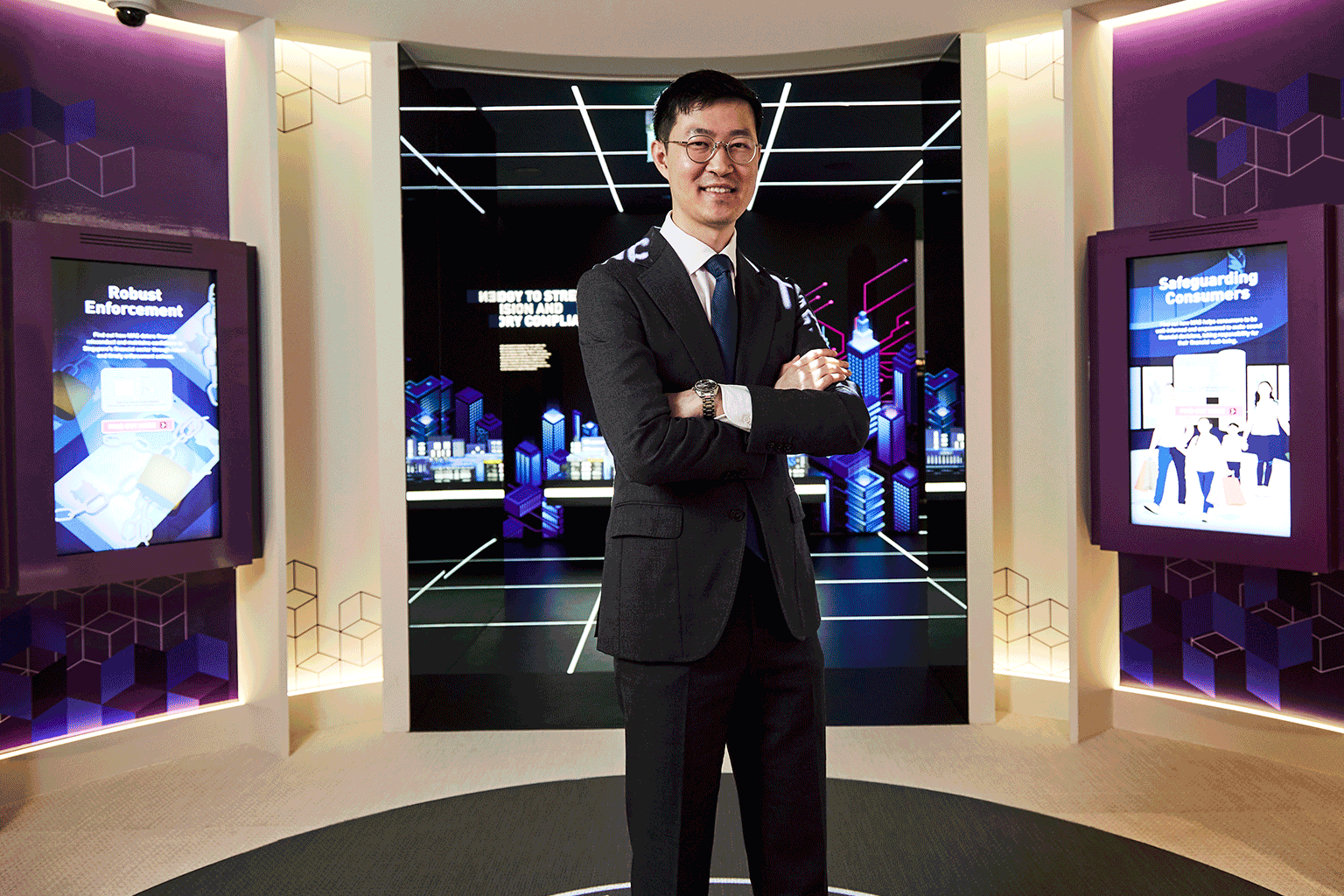

During his junior college days, Andrew Ang developed a keen interest in complex economic issues. Reading The Big Short, by financial journalist Michael Lewis, he learnt about how the bursting of a housing bubble in the United States led to the 2007 global financial crisis.

“It struck me how complex financial markets are, why markets behave in a certain way, how participants react, resulting in the unravelling of markets… these topics really piqued my interest,” he says.

This budding curiosity led him to apply for the Monetary Authority of Singapore (MAS) Undergraduate Scholarship, which took him to Britain to pursue a bachelor’s in political economy from King’s College London and a master’s in finance and economics from The London School of Economics and Political Science. MAS also offers a mid-term scholarship for students at university who share Andrew’s passion for shaping Singapore’s financial centre.

In his second year of university, Andrew had the opportunity to do an internship at MAS. He worked on a project to study the impact of “dark trading” – financial trades that take place outside an exchange. His work contributed to an MAS staff paper, which was used to guide policymaking. It also honed his interest in work relating to financial markets.

He encourages current tertiary students to experience MAS through its internship programme. “Interns are given opportunities to learn new skills and gain new knowledge while contributing to what MAS does,” he adds.

“I am proud to be on the team advancing Singapore’s interests at the international level.”

– Recipient of the MAS Undergraduate Scholarship

“Tertiary education is a formative period to figure out your career interests and goals. The internship can help you crystallise your thoughts after seeing the work we do at MAS, and you might even consider applying for the MAS Undergraduate Scholarship or Mid-Term Scholarship thereafter.”

After Andrew graduated and started working at MAS in 2019, his first posting was in financial supervision within the Capital Markets Group. His work involved ensuring the safety and resilience of financial institutions in Singapore, to mitigate the impact of crises on investors and the broader financial system.

He was on the team that oversaw entities such as exchanges and clearing houses. His job scope included running detailed risk assessments of supervised entities and ensuring that they had proper controls to address their risks.

In 2023, Andrew moved to the policy team within the Capital Markets Group, where he now formulates policies that govern the way MAS regulates and supervises the capital markets in Singapore, as well as the entities that operate in these markets.

Last May, Andrew was in Zurich where financial regulators from around the world had gathered to discuss the future of blockchain-based digital assets.

The 30-year-old was part of the team representing MAS at the International Organization of Securities Commissions (IOSCO) meeting. The meeting was part of a high-level Fintech Task Force set up by IOSCO – and chaired by MAS – to oversee and implement the commission’s regulatory agenda on digital assets, artificial intelligence and other new technologies.

On the agenda was setting global standards for digital assets and other emerging technologies, which could exacerbate existing risks or pose new risks to investors and the wider financial markets.

“Given the global, cross-border nature of capital markets today, our international work has been important in sharing our approach on regulating digital assets and influencing international policy formulation,” he says.

“I am proud to be on the team advancing Singapore’s interests at the international level. In addition to supporting MAS’ efforts at international fora, my work also involves monitoring emerging developments such as digital assets and distributed ledger technology and, where relevant, calibrating MAS’ policy response to such developments,” he shares.

“For example, if there is a novel business model that emerges in the market that does not fit nicely into the existing paradigm of how things are being done, how do we regulate this? Are there any novel risks that arise – if so, how can we address these? These are some of the questions we seek to address.”

Strong, well-regulated capital markets are key components for a vibrant economy, Andrew stresses.

“I look at not just financial risks – which cover market, liquidity and credit risks – but also other kinds of emerging risks, including operational, technological, legal and regulatory risks,” he adds.

Excessive regulation, however, can stifle innovation and growth.

Blockchain and other technologies and developments are transforming how financial instruments are issued, traded and managed. Take tokenisation for example, where financial assets like stocks and bonds are represented as tradeable digital units. While tokenisation can expand investors’ access to financial assets and lower costs of trading, it also poses risks similar to conventional markets like manipulation and fraud.

To create a regulatory environment that fosters innovation while mitigating risks, Andrew has to stay abreast of emerging developments and technologies.

Fortunately, Andrew has support from his colleagues from different departments, who form MAS’ diverse pool of professional talent, to enhance his understanding of the impact of new technologies.

His academic background has proven useful, but Andrew notes that MAS officers come from different fields. “In my policy work, colleagues with legal training help us understand regulations in other countries and compare them with Singapore’s policies,” adds Andrew.

All fresh hires will undergo an extensive, broad-based training programme, which equips them with foundational skills they need as MAS officers.

Andrew’s journey from a curious student to a key player in Singapore’s financial landscape exemplifies the opportunities offered by the MAS Undergraduate Scholarship.

| About the MAS Undergraduate Scholarship Shape the future of financial markets with the prestigious Monetary Authority of Singapore (MAS) Undergraduate Scholarship. Study at top universities worldwide, gain unparalleled career opportunities and join a dynamic team driving innovation. It offers flexibility in your field of study and a guaranteed role with MAS upon graduation. |

The article is brought to you by the Monetary Authority of Singapore.